In short:

- In today’s corporate world, one of the most aggressive business methods is gaining significant importance and is extensively used for reshaping the business environment

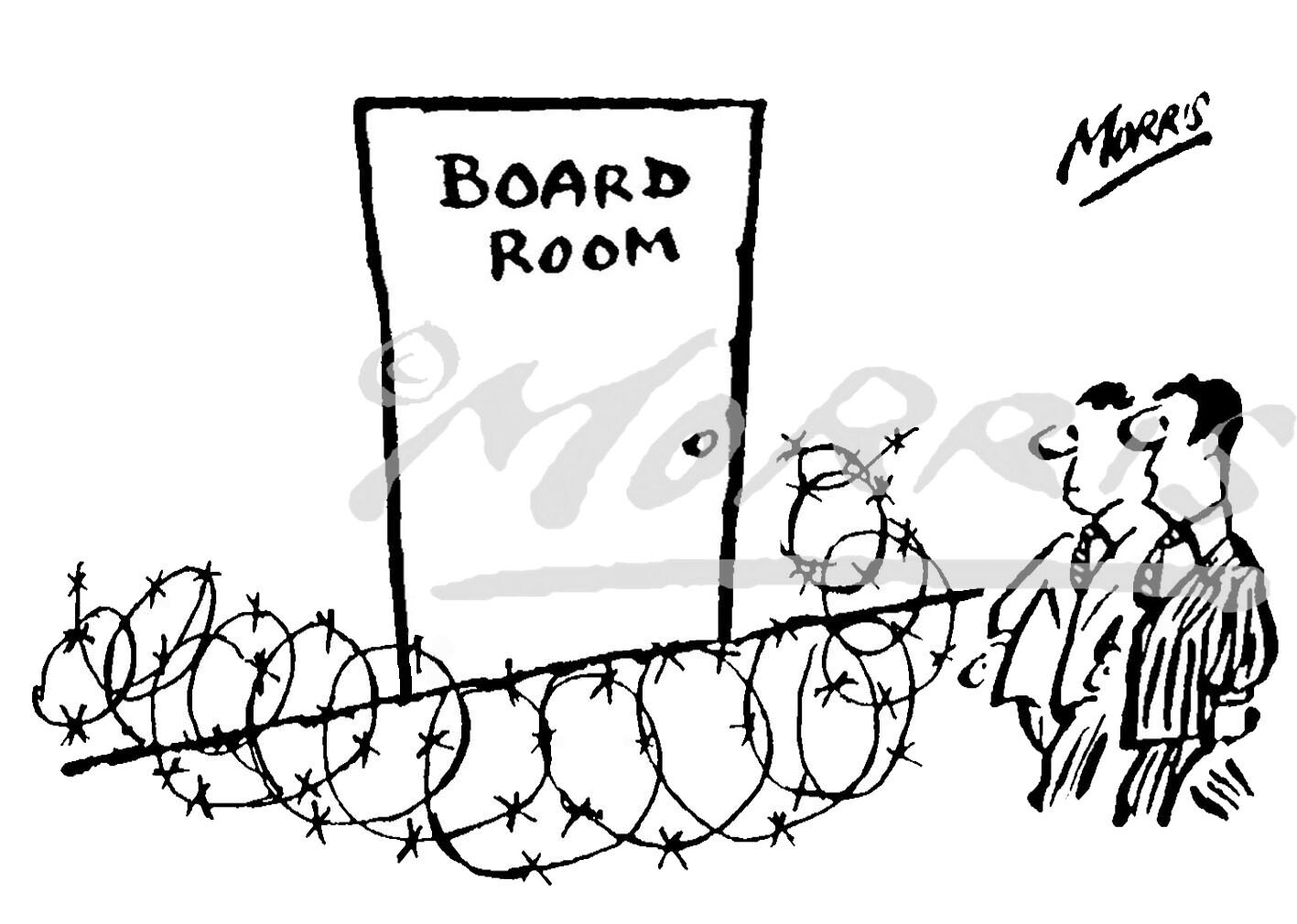

- Targeted companies have several defense mechanisms available to deploy

- Hostile takeovers have a considerable impact on the acquired business, government involvement, and society

Predators, in different shapes and sizes, with an appetite for companies that show current profits and bright future prospects - the ideal victim to a potential hostile takeover. This mechanism is one of which an acquiring company attempts to take over a target company against the wishes of the targeted company’s upper management. Justifications from the acquisition side include, but are not limited to, significantly undervalued businesses, a way to expand its industry foothold, to access the brand, technology, operations or other firm specific advantages.

Such a takeover comes with wounds and scars in which business models and core company values can be altered as a result. Through the acquisition of a defining percentage of shares, the aggressor gains a controlling interest. Subsequently, the aggressor gradually starts to displace former board members and appoint new management - an abrupt shift of company control followed by unplanned change.

Accordingly, the core values of the target company can be adjusted in order to better align with the aggressor company’s core values. Furthermore, new management can alter work dynamics by adopting the aggressor company’s culture, objectives, and strategies which can have a negative impact on the pre-takeover employees. With the realization of significant organizational change, employees can be left in shock which can lead to denial, resistance or occasionally even rejection.

Defense mechanisms for hostile takeovers

Hostile takeovers can drastically affect the target company, merely by the threat that the takeover can transpire. The threat of a hostile takeover may motivate managers to focus on short-term winnings to the detriment of long-term investment strategies. In other cases, the threat can initialize so-called “poison pills”.

A poison pill is a defense tactic of a target company to thwart and discourage hostile takeover attempts. For example, the target company’s management can opt to divest crucial assets that are highly valued by the acquirer or publicly condemn the proposition. The utilization of this defensive strategy is meant to make the target company less attractive to acquire. Simultaneously, the target company may diminish the value of its business assets. “Cutting off the arm to save the body” best expresses the logic behind this strategy.

Government regulation and intervention

The government influences hostile takeovers through regulations, interventions and anti-takeover provisions. For instance, in the United Kingdom it is illegal to implement a defense tactic without the consent of shareholders, once a takeover bid has been materialized. Therefore, defensive strategies such as the poison pill, buying or selling stock with the purpose of interfering with a bid are strictly forbidden. Moreover, in numerous European countries and the United States, governments counteract hostile takeovers if it is considered as a matter of national importance and would therefore disrupt the national economy or market.

For example, in 2016 the large tech-company, Philips, made the decision to sell Lumileds, an American lamp manufacturer, to Chinese financial group Go Scale Capital. The Committee on Foreign Investment in the United States (CFIUS) suspended the deal since it was considered to be of national importance that the business remained American-owned. This indicates a direct relationship between governments and certain hostile takeovers. As a consequence of anti-takeover provisions, regulations and interventions, hostile takeovers are more difficult to prevent for targeted company while other prohibitive laws make it easier to defend a company. In noteworthy circumstances the government intervenes directly with a deal.

Effect on the community

People in communities frequently bear the consequences of merger battles and especially in the case that the target company is a large employer and makes up a significant portion of the local economy. In such a situation, a hostile takeover can lead to substantial organizational alterations within the company with the result of high unemployment and local business privatization.

The result of unemployment arises due to two main reasons. One, huge layoffs can take place after a new board is appointed. Two, hostile takeovers can cause a great deal of uncertainty for employees wondering about a different business culture and new expectations. This may lead to a high turnover rate if employees decide to take control and start job-hunting before internal layoffs begin. Another aspect that is common to hostile takeovers.

Bottom line

In conclusion, depending on the angle one is viewing, merger battles can have a considerable impact on the target company based on the decisions and strategies of the aggressor, legislation and interference of authorities, and involved communities. Organizational changes scaling from change of leadership to completely dissimilar company values are regularly the result of hostile takeovers. Due to the economic impact of hostile takeovers, governments attempt to regulate and manage the acquisition process. Changes in upper management are inclined to lead to transformations in the other organizational levels with the accompanied disadvantages. In light of the above, hostile takeovers can be seen as the dark side of capitalism.