Key Takeaways:

- Banks engaging in sustainable finance enjoy increased net profit, reflecting the alignment of financial success with environmental and social responsibility.

- Banks play a pivotal role in financing sustainable development, showcasing the potential for financial strategies to contribute positively to the planet.

- Government regulations drive sustainable banking efforts by requiring ESG risk disclosure and sustainability considerations in investment decisions.

- Sustainable finance presents challenges but also opportunities for innovation.

Sustainable finance, in essence, is the association between economic expansion, social equity and environmental conservation. The environmental factor is no longer a financial short-term benefit but a mirror that shows the sustainability of the economy, which is very important for the planet and its people as a whole. Sustainability has become a significant trend for banks, as they have become the most active players. They, however, are not just financial intermediaries but also major investors, owning a considerable share of the world's wealth and directly contributing to sustainable development through their financing of operations and investing decisions.

Understanding Sustainable Finance

Sustainable finance, which some might not be aware of, is a new trend in the financial industry. CSR is a key part of this process, as it involves changing the company's goals to be more socially focused. Although traditional finance prioritizes financial returns above all else, sustainable finance is an approach based on economically effective financial and investment practices oriented towards promoting economic growth combined with social and environmental issues. This shift represents a fundamental change in the way investors approach their investments and has the potential to drive positive change across industries and societies.

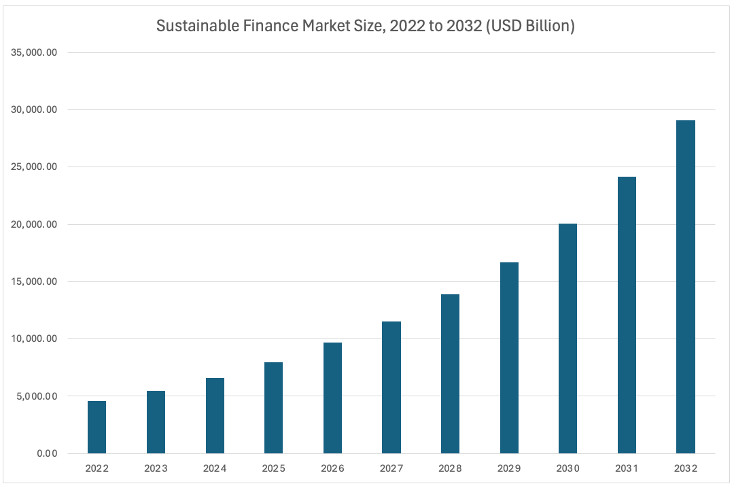

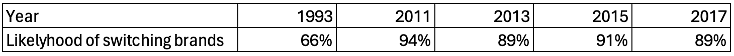

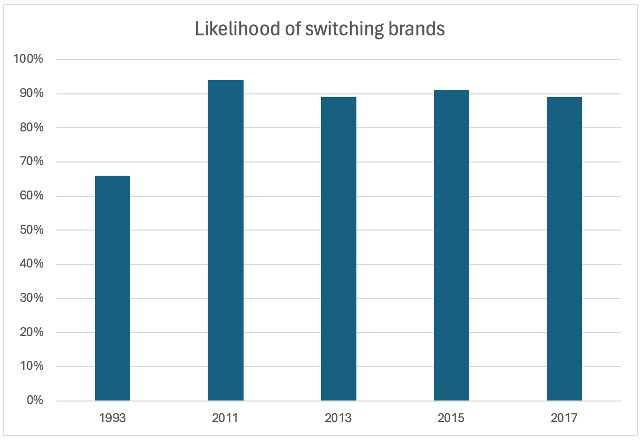

The global sustainable finance market, worth USD 4,562 billion in 2022, is forecast to grow to about USD 29,111 billion by 2032, with an annual compound growth rate (CAGR) of 20.36% between 2023 and 2032. The increasing impact of CSR and sustainable finance is also shown in the growing attention of consumers willing to change their brand or financial institution if it aligns with their values (see Figure 2).

Figure 1: Global Sustainable Finance Market Forecasted Growth

Source: Precedence Research (2023)

Figure 2: Consumers' likelihood to switch brands to one that is associated with a good cause

Source: CONE Communications (2017)

A pioneer in sustainable finance in the banking industry is Triodos Bank, which focuses its funds on projects with a positive environmental and social effect. By providing credits for ecological energy or organic agricultural projects, Triodos proves that banking can be a powerful weapon for those interested in getting financial results and balancing them with ecological ones. Specifically, Triodos Bank's commitment to sustainable finance is reflected in its financial performance over recent years. Despite fluctuations, Triodos Bank has consistently demonstrated its ability to achieve substantial net profits while staying true to its sustainability principles, with a percentage increase in net profit from 2018 to 2023 of approximately 119.32%, compared to ABN Amro with its net profit decreasing by 3% during the same period. These figures underscore the importance of sustainable finance not only as a means to generate financial returns but also as a driver of long-term profitability and positive societal impact.

Figure 3: Triodos Bank NV Net Profit Increase

Source: Triodos Bank NV (2023); Statista (2024)

Financing Activities for Sustainable Development

Banks exert strong influence via lending activities, channeling capital to projects that support sustainable development and thus contributing to the development of innovative solutions that address urgent sustainability issues. The 'Environmental Business Initiative' of the Bank of America perfectly epitomizes how financial strategies can produce real environmental benefits, given that the Bank of America has committed $560 billion in sustainable finance over ten years, with a significant portion, more than $300 billion, earmarked for low-carbon, sustainable business activities. Through this strategy, the Bank of America has provided funding to projects that together have circumvented the emission of over 160 million metric tons of greenhouse gases. Some examples of such projects include various transportation projects focusing on sustainable fuels and electric vehicles, reuse and upcycling, renewable energy installations, and investments in sustainable agriculture.

Investment Decisions and Corporate Practices

Tying environmental, social, and governance (ESG) parameters to investment decisions and corporate practices is also an indispensable driver of sustainable development. HSBC stands out as a banking institution at the forefront of embracing the concept of sustainable financing and investment, in line with the UN Sustainable Development Goals (SDGs) and the Paris Agreement. To date, HSBC has a track record of $210.7 billion worth of sustainable finance and investment focused on environmental and social issues (see Figure 4). HSBC also openly aims to facilitate $750 billion to $1 trillion by 2030 to build a more sustainable future. Such an approach underlines the compatibility of financial goals with sustainability objectives without compromising long-term profits. What is more, this way, banks can also manage risks and spot (investment) opportunities that create long-term value for the clients and society by integrating ESG factors into the decision-making process.

Figure 4: HSBC's Cumulative sustainable finance and investment, 2020-2022 ($BN)

Source: HSBC (2024)

Regulatory Landscape and Policy Implications

Behind the scenes, government regulations and policies are the key factors in leading sustainable banking efforts, with the European Union's Sustainable Finance Disclosure Regulation (SFDR) constituting a fitting example. The SFDR requires financial organizations to provide ESG risk disclosure and incorporate sustainability considerations in investment decisions, thus prompting banks to focus more on sustainable finance. Adherence to regulatory frameworks such as the SFDR sets the same level field for banks, ensuring that sustainability considerations permeate the entire financial system, hence leading to transparency and trust-building from the various stakeholders. This encourages banks to take on less risk and to develop and invest in new sustainable finance products and services.

Challenges and Opportunities

Even though the road to sustainable finance is certainly not void of obstacles, it still offers a chance for creativity and collaboration. Take the example of BNP Paribas, which applies blockchain technology to make sustainable supply chain financing more open and transparent. Monitoring both the environmental and social impact of incentives in real-time by BNP Paribas makes it possible to be accountable and ensure the confidence of stakeholders. Not only do such measures mitigate risk long-term, but they are also an innovative way to build a sustainable and resilient financial system. Nevertheless, data availability, standardization, and regulatory complexity remain significant obstacles to spreading sustainable finance practice. Overcoming these barriers is not only the need of the hour but also the immediate call to action for all actors involved, including governments, financial institutions and others, to develop an environment suitable for sustainable finance.

Conclusion

By using sustainable financing and investing, as well as being committed to both environmental and social responsibility, banks are rewriting a different narrative which is the story of finance for a better tomorrow. While challenges, including data availability and regulatory complexity, remain, regulatory frameworks, such as the EU's SFDR, are the basis of a sustainable finance, and they serve to ensure the transparency of the market and to encourage sustainable practices.

Link 1 ; Link 2 ; Link 3 ; Link 4 ; Link 5 ; Link 6 ; Link 7 ; Link 8