A few years ago, Laura Vasilov wrote this (Link 1) article about questionable financial postulates. If you haven’t read it, make sure to check it out! This article will delve into additional investment theories that can be questioned.

Main takeaways

-

Investment postulates that can be challenged include: (1) the idea that beta and volatility are good measures of risk; (2) the fact that the cost of equity can be accurately known (3) the idea that more information is always an advantage.

-

In reality: (1) beta and vol will not accurately measure risk if price does not always reflect intrinsic value (2) if beta is not a good measure of risk, then the use of asset pricing models to compute the cost of equity becomes questionable; (3) it is difficult to break-down information into noise and signal and predict how investors will react.

-

It is important that investors remain curious and critically evaluate investment theories and news.

1. Risk as beta and volatility

“I find it preposterous that a single number reflecting past price fluctuations could be thought to completely describe the risk in a security.” - Seth Klarman

Both academics and practitioners use beta and volatility to precisely capture a security’s risk. Let’s start off by understanding what beta and volatility are. Financial theory has sought to classify risk into two categories: firm-specific risk (also known as idiosyncratic risk, unsystematic risk, diversifiable-risk) and market risk (also known as economic risk, systematic risk, undiversifiable risk).

Firm-specific risk refers to risk that is specific to one company and will thus not affect the whole economy. Examples include lawsuits, airline crashes or equipment failure. In theory, firm-specific risk can be diversified because it is averaged out and eliminated: negative events affecting one company are offset by positive events affecting another company. Conversely, market risk refers to risks affecting all companies in an economy, such as wars and earthquakes. Therefore, this type of risk cannot be diversified by buying other stocks.

Back to beta and volatility: beta in the capital asset pricing model (CAPM) measures a stock’s sensitivity to market risk. It is the expected percentage change in return given a 1% change in the market portfolio's return. Note that beta can also measure other forms of systematic risk (factors), but this article focuses on beta as a measure of market risk. Volatility, on the other hand, is a measure of total risk, hence including both firm-specific and systematic risks. In mathematical terms, volatility is the standard deviation of returns.

The main problem with both beta and volatility is that they are entirely based on price action, so for them to be good measures of risk (either market or firms-specific), the price changes must perfectly reflect changes in the intrinsic value of the business and its fundamentals. As such, these measures of risk rely on the assumption of efficient markets, which is questionable (see Laura’s article/Link 1 for more on this). It follows that volatility and beta cannot be good risk measures if they do not differentiate between short-term price fluctuations unrelated to value/fundamentals and the material deterioration of business operations. If an investor buys a fundamentally sound business with a margin of safety, then short-term price fluctuations are only relevant if they are forced to sell promptly or if the business seeks to raise cash by issuing stock.

2. The cost of equity is accurately knowable

“Charlie and I don’t have the faintest idea of what our cost of capital is and we think that the whole concept is a little crazy” - Warren Buffett

Directly related to the notion that beta does not capture risk is the debate on whether or not we can accurately estimate the cost of equity, which is basically the return that equity holders expect when they invest their money in a company. The most common way in which it is calculated is by using the CAPM, which tells investors what return they should expect for an asset based on its level of systematic risk. It follows from the previous section that if an investor does not believe that beta accurately gauges risk, then the model is rendered useless. Some problems with the CAPM are: its reliance on historical data, which may not be representative of the future; the fact that it relies on market efficiency (see Laura’s article for more on this); difficulties in selecting the right benchmark to represent the market; the possibility that other asset pricing models might be more appropriate. Recently, researchers found that the value loss from using the CAPM can be on the order of 10% (Link 2).

It was recently estimated that over 80% of professionals (i.e. valuation experts and CFOs) use the CAPM to compute the cost of equity in spite of criticisms (Link 3 , Link 4). So why has the CAPM persisted and become common practice in the professional field? Well, if the CAPM were to be ditched, investors would have to find an alternative way of computing the cost of equity. For instance, using arbitrage pricing models that include additional factors to capture risk (e.g. Fama-French 3 factor model), using an implied cost of capital from comparable firms, using a long-term risk-free rate as Buffett does. All these alternatives come with problems of their own and practitioners seem to favour the simplicity of the CAPM instead of the aforementioned models.

Yet, others may claim that a single correct opportunity cost of capital cannot be computed. Instead, the choice of a discount rate is dictated by the investor’s risk aversion, his preference for present consumption over future consumption and the opportunity cost of her investments.

3. More information is always an advantage

“The growth in available information is exceeded only by the growth in noise” - Nassim Taleb

During any given trading day, a myriad of media articles are published to try and explain why the market closed up or down for that specific day. There are several problems why such information might not always be an edge (Link 5).

First, information might not be veridic. Let’s put aside the fact that fake news is increasingly common. Financial information is often communicated through graphs, tables, statistics, etc. However, it could be difficult to tell if the right research procedure was used to produce the data. In addition, the source(s) may be inherently biased and, thus, not show the complete picture. But let’s assume one can find accurate and veridic sources of information. This leads to a second problem.

The investor might not know whether the information is actually relevant. Separating noise from signal and determining if the information is indeed related to the investment thesis is crucial, but not easy. For instance, people tend to draw connections between things that are seemingly related but, in reality, are not. This is troublesome because investors will draw causal relationships where there are none. The fact that correlation is not causation is well-known but often forgotten. For instance, news sites are fraught with reports on the day-to-day price movement of the stock market. These are typically more about volatility than statistically significant price changes, but the writer will nonetheless attribute the price change to some allegedly relevant reason. Even if the investor has found a true signal, there is yet another hurdle to overcome.

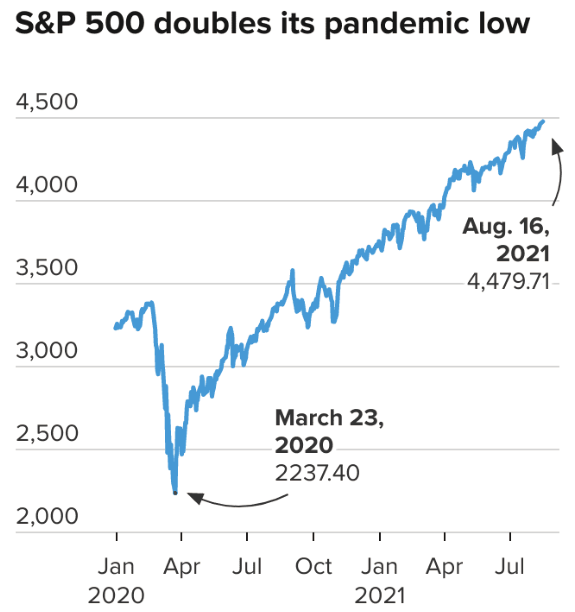

A third problem is that it is difficult to know when or how the market will react to the information (even if it is veridic and affects the security in a relevant way). Imagine that in 2019 you knew with certainty that a global pandemic would break out, millions would die, the retail and hospitality industries would completely shut down and people would be unable to go to the office. One would assume a prolonged recession accompanied by a long-lasting drawdown. Instead, the market reached all-time highs less than a year later, as seen on the chart below.

Source: CNBC

In hindsight, one could try to explain this by arguing that COVID allowed top tech companies to grow considerably, increased retail participation or a shift in market sentiment due to easing of monetary policy. In any case, the point here is that it can be difficult to predict in which direction the market might move in response to new information. But even if one can correctly predict the direction in which the market will move, it is still difficult to foresee when it will happen.

While information can give investors an edge (otherwise, insider trading would not be banned), the above issues also make informational advantages difficult to exploit.

Don’t take it at face value

I’m not talking about a bond, but about information. There are multiple finance theories and schools of thought that contradict each other. Thus, one must question the different assumptions and learn as much as possible. Knowing both sides of the argument will allow you to determine which information to keep and which to discard. If an investor can stick to a long-term plan that is empirically tested and can be systematically followed, then it may be easier to ignore noise and succeed in the market.