Key takeaways:

- Lower Expected Returns: ESG funds likely have lower expected returns because investors pay a premium for aligning with personal values and hedging against ESG risks.

- Questionable Impact on Corporate Behaviour: ESG investing aims to pressure companies into sustainable practices by raising their cost of capital, but evidence shows this effect is often limited and can sometimes work counterproductive.

- Inconsistent ESG Ratings: ESG ratings are inconsistent across different agencies and often focus more on financial resilience to ESG risks rather than actual environmental or social impact.

ESG investing might be hurting your returns without making a significant impact on the world. That’s a bold statement, so let’s break it down with a bit more nuance.

ESG investing—focusing on Environmental, Social, and Governance factors—is very popular right now, especially here in Europe (link 1). People want to align their investments with personal values and reduce ESG-related risks. But is ESG investing as impactful as we think? And do we have to give up returns to do it? Let’s discuss why ESG investing might not be hitting the mark and what these approaches do to our expected returns.

The Impact on Returns

Let’s start with returns. Renowned academics Pastor and Stambaugh argue in their paper, "Sustainable Investing in Equilibrium," that ESG funds likely have lower expected returns. Why? Investors are willing to pay a premium for these funds for two reasons:

- Non-financial personal preferences: They want to feel good about their investments and are willing to pay extra for that.

- The funds' ability to hedge against ESG risks: Hedging is like insurance for which one must pay a premium, in this case by accepting lower expected returns.

So, expecting market-beating returns from ESG investments might be a bit of a stretch, at least theoretically.

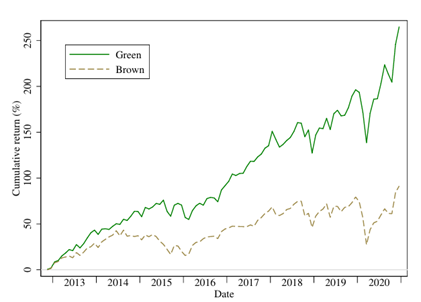

Figure 1: Returns on value-weighted green and brown portfolios. Source: link 2

But why then did ESG investments perform so well in the past? The paper "Dissecting Green Returns" argues that green stocks performed well from 2012 to 2020 thanks to (unexpected) rising environmental concerns. As mentioned, ESG investments could act as a hedge against negative climate news. However, unless there's another unexpected surge in environmental worries, green stocks might not outperform 'brown' (less environmentally friendly) stocks in the future.

The Limits of ESG Impact

So, ESG investors might have to accept lower returns, but that could be okay if they are making an impact, right? Simply put, ESG investing aims to pressure companies into more sustainable practices by raising their cost of capital. But the evidence on whether this actually works is mixed. The 2022 paper "The Impact of Impact Investing" suggests the effect on a company’s cost of capital isn't significant enough to drive major changes. The authors suggest that to have an impact, instead of divesting, socially conscious investors should invest and exercise their rights of control to change corporate policy.

Some research indicates that ESG-focused investors can indeed raise capital costs for environmentally harmful firms, but then the question arises: Do we really want that? Raising the cost of capital for ‘brown’ firms might have unintended consequences.

A 2023 study titled "Counterproductive Sustainable Investing" found that while making it cheaper for green companies to operate doesn’t boost their environmental impact much, making it more expensive for brown companies can worsen their practices. Why? (1) Green firms are already green and can’t get much greener, so pushing their cost of capital down does not make the world much greener. And (2) when brown firms face higher costs, they might double down on pollution or cut corners on mitigation. So, pushing money away from brown companies towards green ones can actually make things worse.

ESG Ratings

Finally, one important point: ESG ratings are often misunderstood. According to MSCI, the leading ESG rating provider, "ESG ratings are not climate ratings" (link 3). Their ratings reflect a company's resilience to financial risks arising from environmental, social, and governance factors. Hence, their ratings focus on protecting profits rather than on creating a better world.

Moreover, a 2019 study, "Aggregate confusion: The divergence in ESG ratings," showed that ESG ratings from different agencies are only 54% correlated. In other words, a company might get a high ESG rating from MSCI and a poor rating from S&P Global or Sustainalytics (some of the largest ESG rating agencies). Unlike credit rating agencies, which typically show a 99% correlation in their assessments, ESG rating agencies often disagree significantly. Clearly, there is a lack of uniform definitions and measurement approaches in the ESG field.

Conclusion

ESG investing sounds great for those who wish to see a more sustainable world with more social fairness and better governance. Many investors choose ESG to feel good about their investments, and that's okay. However, as the former CEO of sustainable investing at BlackRock pointed out, the real-world impact of these investments is debatable (link 4). Its ability to influence corporate behaviour through the cost of capital is limited and sometimes counterproductive.

Additionally, holding greener assets might offer some climate protection, and the strategy has performed well in the past. But this could mean lower expected returns going forward. While considering ESG factors in your portfolio has its merits, whether it can truly make the world a better place is still up in the air.