Key takeaways

- Currency pegs provide stability and reduce exchange rate risk, promoting international trade.

- Maintaining a fixed exchange rate requires significant effort and may divert resources from other monetary policy objectives.

- The level of the peg is crucial, as it can impact trade, competitiveness, and the need for foreign exchange reserves.

In international finance, currency stability plays a crucial role in fostering economic growth and promoting global trade. You have probably heard of currency pegging, the key mechanism that allows for stable currencies across global markets. But have you asked yourself why this is the chosen approach, and how it actually works? How do we make sure the currency stays pegged? Do the pros really outweigh the cons? In this article, we shall embark on a journey to answer those questions.

What are currency pegs?

First, let’s remember that currencies can be exchanged at fixed or floating rates. As the name already implies, the fixed exchange rate allows 2 currencies to be exchanged at a fixed rate, while the floating rate means that the prices between each currency can change depending on market factors (primarily supply and demand). For example, the Hong Kong dollar and US dollar are exchanged at a fixed rate, while the US dollar and the euro have a floating rate.

A currency peg is a policy in which the central bank of a country, or its government, attaches - or pegs - its exchange rate to another foreign currency, or basket of currencies, or another measure of value, such as gold. This results in a fixed exchange rate of that country’s currency with the currency or basket it pegged itself onto. Sounds simple enough, and it is easily understood that pegging to a more stable, widely accepted currency of a broader economy allows for the country’s currency to also enjoy increased stability and long-term predictability. The peg leads to a reduction in foreign exchange risk and possibly less financial losses due to currency fluctuations, so it promotes international trade.

We must also differentiate between soft and hard currency pegs. Given the short explanation above, you are probably imagining hard currency pegs now, which is when a fixed exchange rate is set. This carries a commitment of the country’s central bank to maintain that fixed rate in order to preserve stability - we will get to how this is achieved in just a second. Soft pegs, however, involve setting a target range or band within which the exchange rate is allowed to fluctuate. To an extent, markets do influence the exchange rate, but the central bank often intervenes to strengthen or weaken the currency and allow it to stay within its range.

So how does it work?

The fixed exchange rate is determined by the country’s government and central bank. The rate is based on several economic factors, such as international trade and competitiveness of the country, the stability of its currency and the predicted ability of the central bank to maintain the pegged rate. The central bank also decides on the flexibility of the policy (soft vs hard pegs).

The central bank is tasked to maintain the peg by ensuring the domestic currency rises and falls with the currency it’s pegged to. It does this by buying its own currency when it’s depreciating, and selling it when it’s appreciating. This buying and selling takes place in the foreign exchange market, influencing the supply and demand and thus, the value of the currency. The central bank typically uses its foreign exchange reserves for such transactions, and thus, needs to have large reserves on hand to have enough influence on its currency value. This is the main mechanism employed, but central banks may also adjust interest rates to make investments more or less desirable to foreign investors. These changes cash inflows and outflows – but the bank must be careful not to lose sight of monetary policy goals when maintaining the currency peg. As a last resort, in a truly extreme case, central banks can implement capital controls to restrict the movement of capital in and out of the country, which limits speculative activities and reduces the volatility of its currency. Naturally, the whole process is much more difficult to execute than it seems in theory.

Currently, around 60 countries peg their currencies to the US dollar, which is also the primary reserve currency. As Figure 1 shows, its runner-up is the euro, with 25 countries pegging to it.

Figure 1: Map of currencies and pegs

Source: International Monetary Fund (IMF)

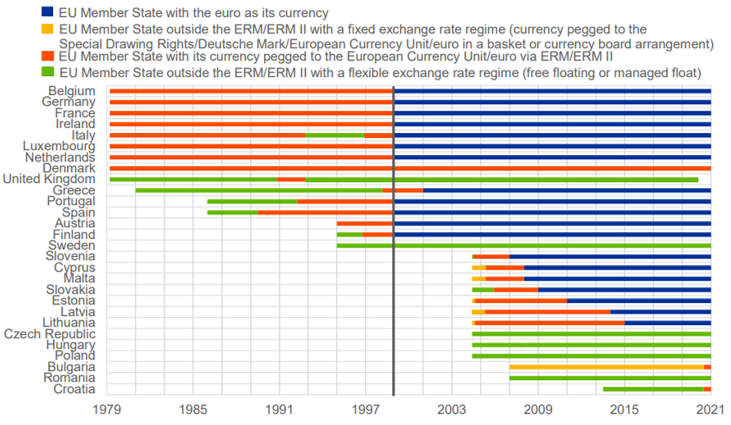

It may be interesting to note that even though it seems logical for EU member countries to peg their currency to the euro before adopting it (perhaps as a way to prove currency stability), some countries maintain their own currency at a fixed rate, and some even at a floating rate:

Figure 2: Exchange rate regimes of EU member states

Source: European Central Bank (ECB)

To peg or not to peg (pros and cons)

We already hinted towards several advantages, such as stabilizing currencies of smaller and less predictable economies. This enables a reduction in exchange rate risk and facilitates international trade. Capital providers may feel more confident in making long-term investments in a country with a pegged rate because there will be fewer fluctuations in the value of their investment. In addition, pegging can make the country seem more credible and trustworthy, which also increases confidence.

Yet, every coin has two sides, and this saying probably carries even more weight in forex markets. One of the obvious disadvantages is that maintaining a fixed exchange rate is quite the task for central banks and likely constrains the time and resources available for its usual duties - controlling money supply, adjusting interest rates, ensuring stable inflation and unemployment rates etc.

Now, it is important to consider the level of the fixed exchange rate. If the currency is pegged at a very low rate, domestic firms and consumers lose purchasing power to buy foreign goods. However, there would be high demand for exports due to the relatively low prices. Currency pegging can therefore massively impact the country’s trade.

But, if the currency is pegged at a rate that is too high, the country’s central bank may not be able to maintain it because consumers may start buying too many imports due to their relatively low price, driving up demand for them. This, accompanied by falling demand for expensive exports, reduces the country’s competitiveness and creates a trade deficit. A persisting trade deficit puts downward pressure on the domestic currency, so if the central bank wants to keep it pegged, it must spend a large proportion of its reserves to artificially increase demand. This entails another important point: to be able to defend the currency peg, large foreign currency reserves are required; building and maintaining them is costly in itself. The likely failure of the high currency peg leads to currency devaluation and high inflation, which in turn leads to difficulties in repaying the country’s debt. As we can see, the consequences are more than alarming.

A compelling argument could be made to use soft pegs to mitigate some of these risks, as it entails keeping the exchange rate in a target range. Already, this alleviates some of the pressure on the central bank to maintain the rate, allowing it to focus more on its monetary policy. There is also a smaller risk of pegging at too high or too low rate, since we peg at a range. Nevertheless, regular central bank intervention is still necessary, and the issue of needing to hold large foreign exchange reserves persists. A downside of the soft peg could be lower credibility, as the central bank may appear to be uncommitted to maintaining a strict rate and allowing the currency to fluctuate vigorously. As we know, credibility is a central bank's most important tool, making this a large disadvantage. In spite of this, Figure 3 shows that soft pegs do make a compelling case, as they dominate fixed regimes.

Figure 3: Overview of exchange rate policies

Source: Congressional research service

Bottom line

In conclusion, currency pegs serve as a mechanism to provide stability and reduce exchange rate risk, promoting international trade and attracting investments. However, maintaining a fixed exchange rate requires significant effort and diverts resources from other monetary policy objectives. Incorrectly setting the peg can lead to adverse effects such as loss of purchasing power, trade imbalances and difficulties in defending the peg. Soft pegs offer flexibility, but still require intervention and may impact central bank credibility. Ultimately, the effectiveness and therefore choice to peg their currency depends on a country's specific circumstances and its ability to manage associated risks.