Key takeaways:

- M&A activity, while still below the historical yearly average, has shown signs of an uptick in industries such as business services and prepackaged software.

- There has been an increase in investor sentiment towards M&A activities compared to 2023.

- The global macroeconomic environment appears to be favoring deal-making. However, projections still predict below-average M&A activity globally in the upcoming 6 months.

Inspired by Boston Consulting group’s editorial series on mergers and acquisitions, this article focuses on the M&A activity until October 2024, and subsequently projects outlook for the first half of 2025. This has been made possible using the comprehensive list of M&A announcements collected by SDC platinum, the mergers and acquisitions sentiment index by BCG and insights from the recent announcements on the change in monetary policies by governments of major economies around the world.

The M&A market has been trending downward since the start of 2022. Major reasons for this include geopolitical tension around the world, rising interest rates and fears that the FED would not temper inflation without a recession. Furthermore, 2024 being the election year in some of the largest democracies in Europe, the United States and India, might have caused decision makers to pause on their M&A ambitions. Since then, dealmakers have been reluctant to return to the table. As of October 2024, the overall M&A activity around the world inclusive of deals completed, intended and status pending stood at 778 billion USD. Putting this into perspective, the overall M&A activity around the world for the years 2021, 2022 and 2023 amounted to 1.984 trillion, 1.072 trillion and 981 billion USD respectively. The figure below illustrates the regions with M&A activity around the world, including leveraged buyouts, stake purchases, spinoffs, privatizations, tender offers and acquisitions of remaining interest.

Throughout the first ten months of 2024, the highest levels of M&A activity were observed in the USA and the UK with deal values totaling roughly 185 billion and 77 billion respectively. While this year’s downtrend in deal volume is clear, some countries have fared better than others. For example, the UK experienced an increase of 32% in deal values compared to the first ten months of 2023.Additionally, there are some signs of a potential recovery. According to BCG, M&A sentiment remains low, but has increased since last year and is currently accelerating. Their Global Market Sentiment and Momentum Index is an indicator of the potential willingness of dealmakers to indulge in mergers and acquisitions in the next six months. The index is calculated using valuation levels, interest rates and business activity, among other measures. Currently, the index stands with a low score of 88, with a value of 100 impliying that M&A activity is set to mirror the 10-year historical average.A value of 88 indicates that the sentiment is somewhat accelerating, but the M&A activity is still set to remain below average over the upcoming 6 months. The following section investigates the industries where the deal value contributed significantly to the overall activity in 2024.

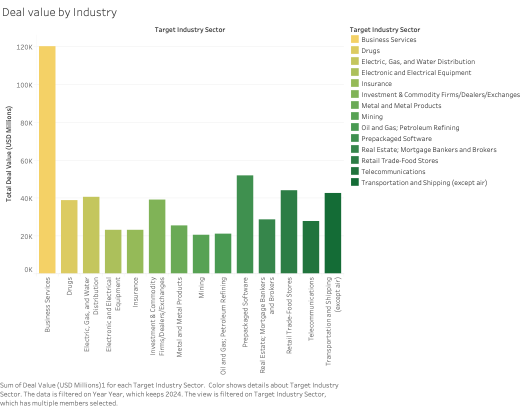

Deal values across industries

As of October 2024, the business services industry had the highest aggregate deal value amounting to 120 billion USD globally. This accounted for 15% of M&A investments globally. In comparison to the total acquisitions as of October 2023, the business services industry experienced an approximate 58 percent increase. Coming in second were acquisitions made in the prepackaged software industry. As seen on the figure below, the total deal value amounted to roughly 52 billion USD, which is a 9.5% increase in comparison to 2023. As per BCG’s 2023 M&A report, these increasing figures can be attributed to the current push in digitization globally. Recent advancements in technological areas such as generative AI and robotics remain key drivers of M&As. For example, Blackstone recently announced its intent to acquire Air Trunk, a leading Asia Pacific data center technology firm for a value of roughly 16 billion USD. With a capacity of supplying 1 GW, Air Trunk offers Blackstone the ideal opportunity to become the leading investor in digitization infrastructure.

Among the other industries contributing significantly to the M&A activity globally were the retail trade-food stores, transportation and shipping, electric, gas and water distribution and investment and commodity exchange platforms.

The three largest deals announced in 2024 as of October were:

- Alimentation Couche Tard Inc’s acquisition of Seven & i Holdings co Ltd at a value of 38 billion USD.

- Blackstone’s acquisition of Air Trunk for 16 billion USD.

- DSV A/S acquisition of Schenker A/G for roughly 15 billion USD.

The proposed consideration structure of cash only for all these deals indicates that large investors have plenty of dry powder.

What to expect in the upcoming six months in the M&A landscape

- Firstly, increased investment by firms within the technology space in lieu of rapid developments in digitization and energy transition. The 58% increase in the business services and 9.4% increase in prepackaging software industries are indicative of the industries that investors are focused on.

- Secondly, a common theme noted in this analysis has been the availability of capital. Large corporations appear to have abundant funds. The build-up in dry powder might allow acquirors to pursue some large-ticket deals.

- Easing in financial conditions across major economies could be beneficial for M&A activity, as lower hurdle rates could facilitate deal-making. Within the United States, the FED has reduced rates by 50 basis points and is likely to continue its cutting cycle. The European Union has also announced a reduction in interest rates. Within the Asian continent, the Reserve Bank of India too has chosen to keep their powder dry. They are employing a more flexible approach, with rate reductions aimed towards the end of the year. Thus, all in all, the remainder of 2024 and 2025 appears to be a more favorable environment for deal-making globally. However, the existing geo-political tensions still form an important variable to be considered when dealmakers approach new deals.