Key Takeaways:

-

The carry trade often involves borrowing in low-interest-rate currencies and investing in high-interest-rate currencies, capitalizing on a market anomaly known as "the forward premium puzzle".

-

Profitability of carry trades depends on the interest rate differential and exchange rate movements, making it vulnerable to shifts in monetary policy or global economic conditions.

-

Leverage is often used in carry trades, which magnifies both potential returns and risks.

-

The unwinding of carry trades can happen quickly and on a large scale, significantly increasing market volatility.

Market Crash in One Day

On August 5, 2024, global markets were shaken as Japan's Topix and Nikkei 225 indexes plummeted more than 12%—the steepest single-day drop since 1987. The S&P 500 also fell by 3% on the same day. For many, this sudden crash evoked memories of "Black Monday" on October 19, 1987, when the Dow plunged 22.6% and the Nikkei 225 dropped 14.9%.

Figure 1: Nikkei 225 Year-to-Date Performance (as of September 20, 2024)

Source: Yahoo Finance

Figure 2: S&P 500 Year-to-Date Performance (as of September 20, 2024)

Source: Yahoo Finance

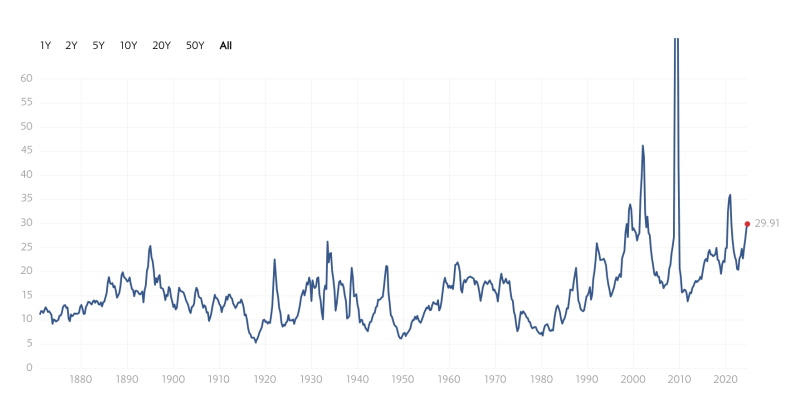

The timing of this crash was particularly alarming: the S&P 500 had recently hit a historic high, with a price-to-earnings (P/E) ratio exceeding 29, well above its long-term average of around 16. Discussions about U.S. stock market overvaluation and speculative bubbles had been circulating for some time. With the appearance of an inverted yield curve in 2022—often a precursor to recessions—and rising market volatility, fears of an economic downturn grew stronger. (Read Omar Khalil's and Paolo Parboni's articles for more on the inverted yield curve.)

Figure 3: S&P 500 P/E Ratio (January 1981 - September 2024)

Source: multpl

Figure 4: U.S. Government Bond Yield Curve (as of September 20, 2024)

Source: Investing.com

This raises a crucial question: What triggered the crash?

Carry Trade

One key factor in the market turbulence was the investment strategy known as the "carry trade," as highlighted by multiple reports. In a carry trade, investors borrow money at low interest rates to invest in assets with potentially higher returns. This strategy is particularly common in foreign exchange (FX) markets, where investors borrow in a low-interest-rate currency and invest in higher-yielding assets denominated in another currency, profiting from the interest rate differential.

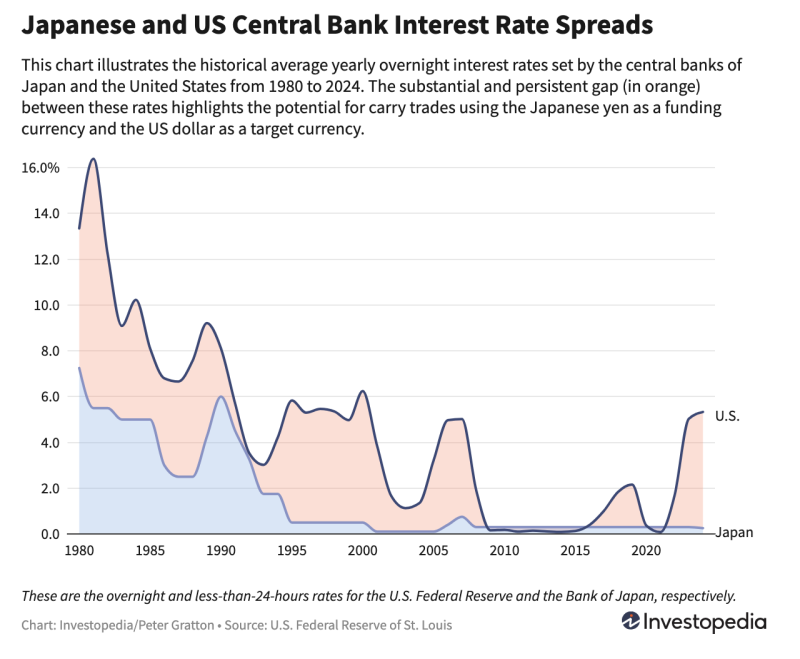

A popular form of the carry trade is to borrow in Japanese yen and invest in U.S. dollar-denominated assets. Over the past decade, the Bank of Japan (BoJ) has maintained a near-zero benchmark interest rate, while the U.S. Federal Reserve (Fed) has raised its benchmark rate from 0.25% to 5.5% since 2022. The significant interest rate gap between the two currencies made yen carry trades highly profitable— investors borrowed yen at minimal cost to purchase U.S. assets with much higher returns.

Figure 5

Source: Investopedia

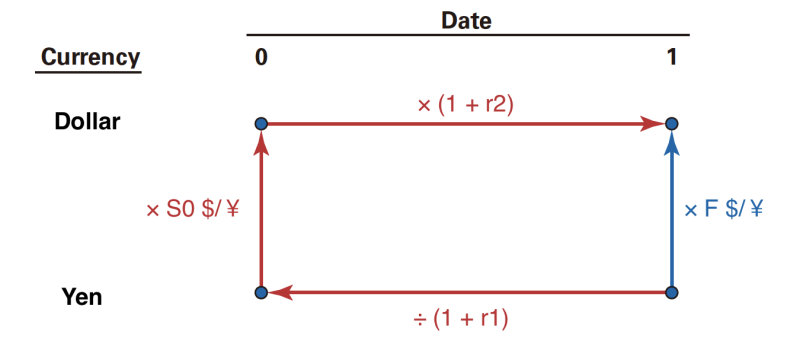

Theoretically, exploiting the interest rate differential across markets should be unprofitable due to the concept of interest rate parity (IRP) in an efficient market. According to IRP, the (expected) exchange rate movements should offset any potential arbitrage gains. For example, if the spot exchange rate is S₀ USD per JPY, with a borrowing rate of r₁% in yen and a lending rate of r₂% in dollars for one year, then the 1-year forward exchange rate (F) would be S₀ * (1 + r₂) / (1 + r₁). Given that r₁ < r₂ (0% < 5.5%), the U.S. dollar is expected to depreciate while the yen appreciates (F > S₀). This would imply that any profits from the interest rate differential are offset by unfavorable exchange rate movements.

Figure 6: Interest Rate Parity & No-Arbitrage Forward Exchange Rate

Source: adapted from Corporate Finance (Berk & DeMarzo, 2017)

However, reality often deviates from theory. Carry traders often exploit a persistent market anomaly known as the "forward premium puzzle," where, contrary to interest rate parity, currencies with higher interest rates tend to appreciate rather than depreciate in the short term. This phenomenon is well-documented and is evident in the JPY/USD exchange rate movements. As shown in the graph below, the U.S. dollar has appreciated by approximately 26% against the yen since 2022 (from 0.0087 to 0.0069 per JPY), coinciding with Fed's rate hikes.

Figure 7: JPY/USD Exchange Rate Over the Last 5 Years (as of September 20, 2024)

Source: Yahoo Finance

As a result, carry traders benefited not only from the interest rate differential but also from favorable exchange rate movements. For instance, if an investor borrows 1 million yen at 0% for a year and invests in U.S. Treasury bonds yielding 5.5%, with the exchange rate shifting from 0.0077 to 0.0070 during that period, the outcome is significant. Initially, 1 million yen converts to $7,700 (1,000,000 * 0.0077). After a year, the dollar-denominated investment grows to $8,123.50 ($7,700 * (1 + 5.5%)), which, when exchanged back, equals 1,160,500 yen—a 16.05% rate of return.

Estimating the exact size of yen carry trades is challenging due to the variety of methods traders use to short (i.e. borrow) the yen, including yen-denominated debt and derivatives like yen forwards and futures. However, several indicators suggest substantial activity. According to the Wall Street Journal, Japanese banks' foreign lending reached US$1 trillion as of March, marking a 21% increase from 2021, based on data from the Bank of International Settlements (BIS). Additionally, Japanese investors' net international investment totaled ¥487 trillion (approximately US$3.3 trillion) as of the first quarter, reflecting a 17% increase over the past three years.

Risks with Carry Trade & Unwinding

The carry trade strategy can be highly profitable during periods of market stability. However, it is vulnerable to sudden market shifts, particularly when funding currencies like the yen appreciate rapidly, potentially wiping out months or even years of accumulated carry profits. Additionally, the strategy is sensitive to changes in interest rates. Any central bank adjustment to interest rates can narrow the rate gap, threatening the strategy's profitability.

In the recent crisis, two key events triggered the downturn of stock indices. First, on July 31, 2024, the Bank of Japan unexpectedly raised its benchmark rate from around 0.1% to 0.25%, immediately putting pressure on carry trades funded by the yen. Second, on August 2, the U.S. released a jobs report showing the addition of only 114,000 jobs in July—below the 175,000 expected by investors. The weaker-than-expected job growth heightened speculation of a potential Fed rate cut, which would further shrink the interest rate gap that had driven the carry trade's profitability.

The result was a rapid appreciation of the yen. Between July 29 and August 5, the Japanese yen appreciated by approximately 6.15%, rising from 0.0065 to 0.0069 USD per JPY. This rapid increase in the yen's value triggered a massive unwinding of carry trades, as investors quickly exited the strategy by selling the dollars and buying back the yen to avoid further losses.

Figure 8: JPY/USD Exchange Rate Over the Last 3 Months (as of September 20, 2024)

Source: Yahoo Finance

It's important to note that many carry traders use financial leverage, including FX forwards and futures, to amplify returns. When the market turns against them, margin calls force them to close positions at a loss, accelerating the unwinding process. As more short-yen investors are forced to liquidate their positions, the yen continues to appreciate, creating a vicious cycle of forced selling and further currency appreciation.

The final stage of this chain reaction was a collapse in the stock market. The stock market recovery in Japan had been driven by exporters, who benefited from a weaker yen, as much of their revenue is earned overseas but reported in yen. With the sudden yen appreciation, these companies faced severe headwinds. For example, Tokyo Electron, a major supplier of semiconductor equipment, saw its share price plunge by 18% on August 5. Two days later, on August 7, BoJ attempted to calm the market, with its deputy governor stating, "the central bank won't hike interest rates when markets are unstable."

Bottom Line

What will all this lead to? Few analysts believe that Japanese firms or the country's financial system are in serious distress, and both the Japanese and U.S. stock markets recovered after the crash. However, some warn of potential volatility ahead—particularly in the U.S. stock market, where major tech companies like Nvidia and Apple are facing challenges. In a globalized world, such turbulence in one region can quickly spread across markets, emphasizing the interconnected nature of the global financial system.